Buying a Home with an ITIN in Florida and Illinois

- Mark Kelner

- Jul 5, 2023

- 2 min read

Updated: Jul 24, 2023

Buying a Home with an ITIN (individual taxpayer identification number) in Florida and Illinois is not only possible but can be a fulfilling venture. At One Republic Mortgage, we offer a range of ITIN mortgage programs to make your dream of homeownership a reality.

Here's what you need to know to get started:

Assessing Your Financial Readiness:

Before embarking on your homeownership journey, it's essential to evaluate your financial situation thoroughly. Our experienced Loan Officers can help you navigate this process, which includes:

Organizing Your Financial Documents: Gather essential financial documents, such as proof of income, bank statements, and tax returns. Our team can guide you through the process of preparing these documents to ensure a smooth mortgage application.

Reviewing and Improving Your Credit: Understand the importance of a credit report and address any discrepancies or outstanding debts. Our experts will assist you in assessing your credit and offer guidance on improving your credit score, if necessary.

Calculating Your Budget: Determining a suitable monthly mortgage payment is crucial. Our Loan Officers will work with you to calculate a budget that aligns with your financial capacity and homeownership goals.

Finding the Right ITIN Mortgage Program:

At One Republic Mortgage, we specialize in providing ITIN mortgage solutions to individuals in Florida and Illinois. Our team of experts has extensive experience working with borrowers who have an ITIN. Whether you're a first-time homebuyer or an experienced investor, our reputable lending institution can guide you through the process.

Homebuyer Education and Guidance:

To ensure you make informed decisions, consider participating in homebuyer education programs or workshops. Our team will provide valuable insights into the home-buying process, financial management, and the responsibilities of homeownership.

Tailored ITIN Mortgage Programs:

We offer a variety of ITIN mortgage programs designed to meet your specific needs and preferences. Our Loan Officers will assist you in selecting the most suitable program, making your homeownership journey more convenient and accessible.

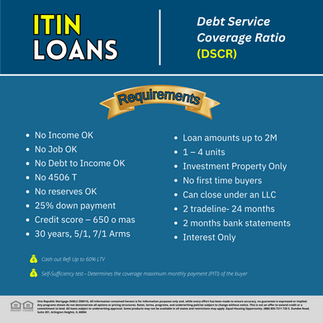

Understanding ITIN Mortgage Requirements:

It's essential to recognize that ITIN mortgages may have varying requirements compared to traditional mortgages. Our experts will walk you through the nuances, such as down payment considerations, interest rates, and income verification, to help you make informed decisions.

Home Inspections and Appraisals:

Protect your investment by prioritizing home inspections and appraisals. Our team can recommend licensed professionals to ensure the property's condition is thoroughly evaluated, helping you make a well-informed decision.

Navigating the Closing Process:

Familiarize yourself with the closing process specific to Florida and Illinois. At One Republic Mortgage, our team of professionals, including lenders and attorneys, will work closely with you to ensure a seamless and successful closing.

Comentários